Table of Content

Check out the businesses we found with the most cost effective rates for drivers with an infraction on their record. Infinity ($113/mo), Direct Auto ($121/mo), and Gainsco ($126/mo) supply related rates as well. You start to see charges enhance with Acceptance at $144/mo, Mercuryat $154/mo,Travelers at $158/mo, andSafecoat $158/mo. The minimal required insurance have to be issued by way of a Florida agent with an insurance coverage firm licensed to promote in Florida. Ask your agent to switch your present insurance coverage to Florida when you register a vehicle in Florida.

Taking a defensive driving course or driver’s education course could earn a discount in your auto policy. Insurance CompanyMonthly PremiumInfinity$125Assurance America$143Direct Auto$155Gainsco$163Acceptance$174You can see a big difference in rates when you could have one ticket vs. a number of tickets. Rates then proceed to increase with Assurance America ($143/mo), Direct Auto ($155/mo), and Gainsco ($163/mo). While charges usually improve barely as you hit 65+ it doesn’t imply you must accept unaffordable charges.

Low Cost Car Insurance Boca Raton Fl

A credit score rating under 670 can impact your insurance premium, with Florida drivers paying a median of $2,514 more if they've poor credit. These two insurers also supply the most price effective full coverage insurance coverage for drivers with good credit. Make positive you ask the agent you speak with about what you are capable of do to get Florida reasonably priced automobile insurance coverage. Get them to undergo all the auto insurance coverage reductions they offer so you do not miss any. We’ve identified 9 companies that provide the most affordable rates for Florida’s minimal coverage requirements. Finding affordable car insurance coverage forteenage driversin Florida is simpler than you might think.

Novice drivers should be especially careful to take care of a clear driving record and comply with all pace limits and other driving regulations. Some FL insurance companies can present more favorable charges than others for younger drives. It's worth getting a number of quotes so you can save cash on your monthly insurance coverage premiums. Florida is among the costliest states within the nation for automotive insurance coverage.

How A Lot Is Automotive Insurance Coverage In Florida?

Your precise quoted rate may vary tremendously and could additionally be subject to adjustment based mostly on verification of your self-reported data. Your liability-only coverage will cover the cost of any damage, accidents, or deaths you trigger in an accident, as a lot as the coverage limits. Car insurance coverage necessities by state for more particulars on coverage you could want in your Florida auto coverage.

Its app allows you to entry your ID card, file a declare, contact or even sign insurance coverage documents. Or you'll be able to reach out to your local agent if you prefer more private interactions. For instance, if you’re 80% answerable for an accident, your insurance coverage can pay 80% of the other driver’s damages.

And, the more you’re on the street, the extra at-risk you might be to get in an accident, which means larger premiums. However, based on the Bureau of Transportation, Floridians drive a mean of 33.4 miles per day, that’s below the typical across the US of 36.1 miles per day. Your car’s make, mannequin and trim instantly affect how much you’ll pay for automotive insurance coverage. Things like its cost, security rankings, the likelihood of theft, and sportiness all help insurers decide its cost to insure. And guess what, the insurance commissions and advertising fees are already baked into the value of an insurance coverage policy, so you’re not paying anything further for utilizing our site to get coverage.

Pay-per-mile insurance, which charges drivers by what number of miles they drive. The scoring formulas keep in mind multiple information factors for each monetary product and repair. We believe everybody should have the power to make financial selections with confidence.

Necessary Florida Contacts

Case in point, the difference between essentially the most affordable and costly suppliers within the state is $3,507 per yr. In Florida, climate events like severe storms, droughts, and tropical cyclones have gotten more and more common. These climate occasions trigger insurers to pay out a higher number of claims, which tend to be dearer and less predictable. The state's shut proximity to the ocean influences many elements of Florida culture and day by day life. Florida is a reflection of influences and a quantity of inheritances; African, European, indigenous, Latino, and Asian heritages can be found in the architecture and cuisine.

You might also consider gap insurance coverage, designed to pay for the distinction between your loan value and the vehicle’s precise money value if your new automotive is stolen or totaled. Gap coverage usually costs much less if you would possibly be going to buy it out of your auto insurer versus your lender. Each of these factors impact on what corporations fit your needs and the price of your premiums. You may find it helpful to weigh different components, like whether or not an organization has a highly rated cellular app or the most cost effective protection, to determine what firms are greatest for you. Below you’ll see common annual rates for main insurance coverage providers in Florida, ranked most cost-effective to expensive for liability insurance coverage. The protection limit for the below-mentioned rates is $50,000 for bodily damage per particular person, $100,000 for bodily injury per accident and $50,000 for property harm.

Check out Compare.com’s comprehensivevehicle prices breakdownto be certain to account for all the added prices you might be on the hook for when buying a automobile in Florida. Driver Affiliation Discounts.Are you a member of an alumni affiliation, college or college, fraternity, sorority, leisure, business or professional organization? If you answered yes, ask your auto insurer should you qualify for added discounts based on your affiliation.

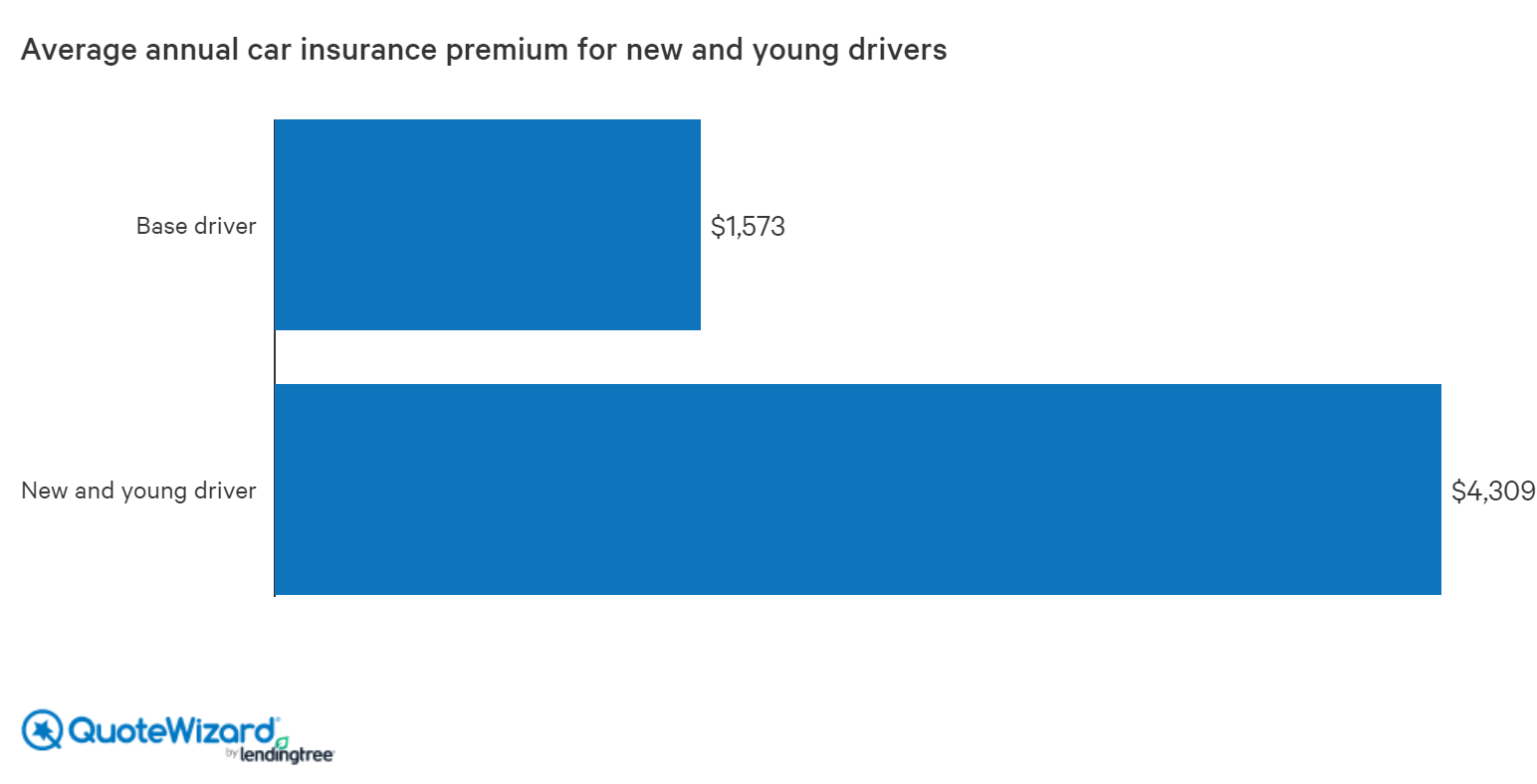

However, with the second-highest rates within the country, Louisiana has Florida beat, with a mean annual premium of $2,864 for full coverage. The average cost of full protection automobile insurance in Florida is $2,780 per yr, or about $232 per thirty days, according to NerdWallet’s analysis. Minimum protection in Florida is $1,084 per yr on average, however we discovered you presumably can doubtless get a less expensive coverage. For example, Geico presents the most price effective charges in Florida at $717 per year, on average, for minimal protection automotive insurance coverage for a 35-year-old driver with a clean driving document. Inexperienced drivers pose a higher risk to insurance providers so their charges may be significantly larger than average drivers.

No comments:

Post a Comment